The policy’s implementation is also expected to establish a path in which the Vision 2050 policy goals can be achieved. Overall, the policy identifies six ‘recovery’ areas, which are Port, Energy, Industrial, Urban and Rural, Green Growth, and State Productivity recovery. Each of these recovery areas aim to overcome obstacles that limit Mongolia’s development.

This New Revival Policy presents opportunities to further develop EU-Mongolian trade and investment ties, building on Mongolia’s participation in the GSP+ Scheme (General Scheme of Preferences Plus), and the 2017 ratification of the EU-Mongolia Partnership and Cooperation Agreement (PCA). Specifically, the policy’s plan to expand Mongolia’s Free Economic Zones (FEZs), as well as improve domestic transport and sustainable energy sources provide the EU with opportunities to invest in, and aid Mongolia to achieve goals set out in the New Revival and Vision 2050 policies. For instance, the Green Growth strategy’s Billion Tree initiative provides opportunities to collaborate with Mongolia in combating desertification, as well as for the EU to invest in new streams of employment in the agricultural and forestry sectors. Moreover, given Mongolia’s GSP+ beneficiary status, which provides them duty-free exports on 66% of listed goods to the EU, the revival policy also presents opportunities for Mongolian businesses to expand their presence in the EU market and for EU businesses to expand their operations in Mongolia.

This Op-ed will analyse the New Revival policy and the key policies of each of the recovery areas. It will also look into how the EU can further invest in Mongolia, taking a focus on the mining and energy sectors, as well as on green development.

The New Revival Policy: A Post-Pandemic Renaissance

The New Revival policy aims to encourage Mongolia’s post-pandemic recovery by opening up the country to domestic and foreign investment. Such builds on the Vision 2050 policy, which aims to enhance Mongolia’s ‘social development, economic growth and its citizens’ quality of life’ by 2050. The Vision 2050 policy aims to achieve this by reducing poverty, creating a greener economy, improving the quality of education, and improving job access and equality for women. During the 2021 United Nations General Assembly (UNGA), President Khürelsükh announced Mongolia’s aim to implement the Billion Tree initiative, which was then included in the New Revival policy. Then in December 2021, Prime Minister Oyun-Erdene outlined how the New Revival policy’s full implementation would see Mongolia’s GDP double, and the creation of a further 285,000 jobs by 2025. Moreover, he articulated how the policy would also see a doubling of the state’s energy capacity, and a tripling of dry port, land (border) port and airport capacity. Although the policy’s implementation is set to cost 100-120 trillion MNT (33-40 billion USD), he also argued that the policy’s outcome would see an improvement in Mongolians’ living standards, an increase in better-paying jobs in rural areas, and that the generated income will facilitate other developmental projects in the state.

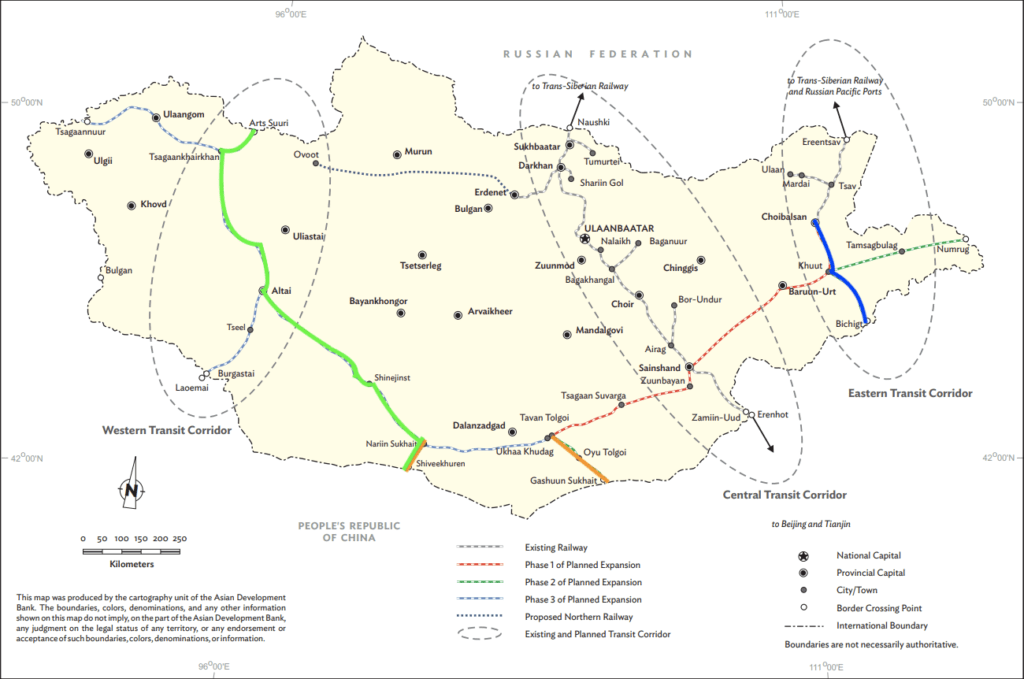

Having attracted investment from China, Japan, and Kuwait, the Port Revival policy aims to increase the capacity of Mongolia’s dry ports, land ports and airports, and improve the state’s transport infrastructure. Such is to encourage inter-regional competition and facilitate international trade. This policy includes the expansion of the Mongolian railway and highway network, as well as plans to further expand airport capacity. The rail expansion plans include the construction of railroads at the Gashuunsukhait-Gantsmod and Shiveekhuren-Sekhee border checkpoints (Figure 1), as well as plans to construct cross country railways, such as the 1200km western Artssuuri-Nariinsukhait, Shiveekuren railway, and the eastern 420km Choibalsan-Khuut, Bichigt railway (figure 1).

Figure 1: Proposed Railway

Choibalsan-Khuut, Bichigt = Blue Line

Gashuunsukhait-Gantsmod and Shiveekhuren-Sekhee = Yellow Line

Artssuuri-Nariinsukhait, Shiveekuren = Green Line

Original Source: CAREC

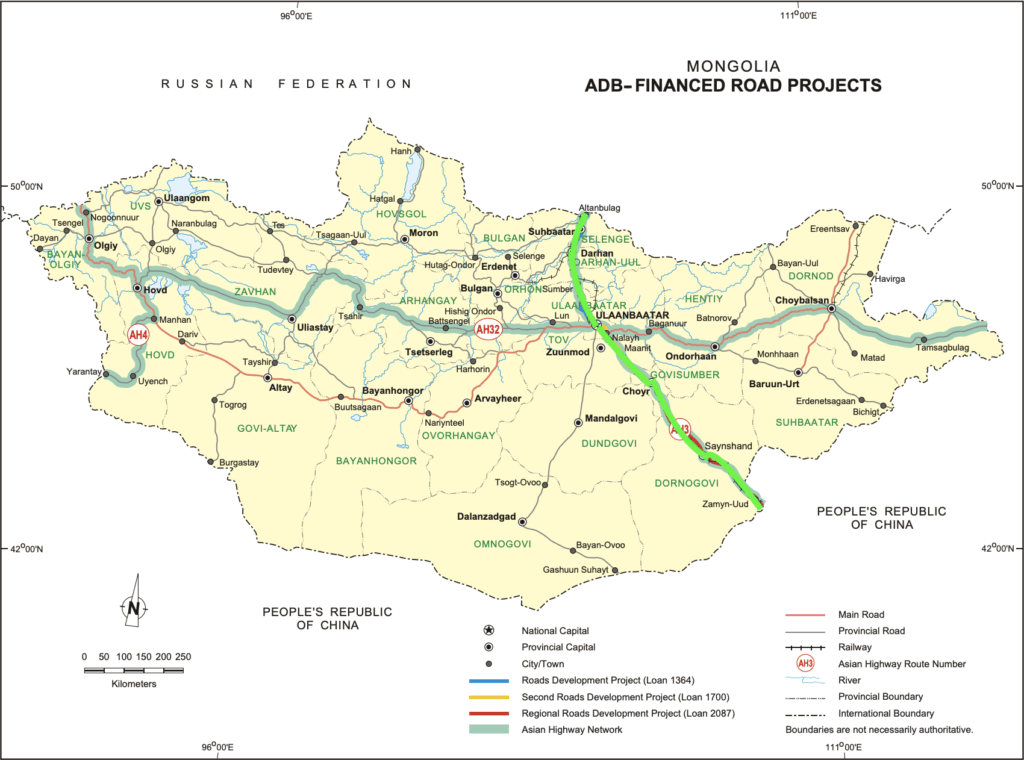

The highway expansion includes the plan to build the 987 km Altanbulag, Zamiin-Uud highway which aims to connect Chinese and Russian border ports by road (Figure 2). Moreover, the airport expansions include the new Kuwait-funded Undurkhaan Airport, and the Deluun Boldog Airport, both of which are still under construction. This has been further coupled with the expansion of free economic zones (FEZ), such as the recent commissioning of the Khushig Valley FEZ.

Figure 2: Highway Developments

Orginal Source: ADB

The improvement in transport infrastructure feeds into the Industrial Revival strategy. This strategy aims to diversify Mongolia’s export market through the establishment of more value-added mining and agricultural processing plants (such as the Tavan Tolgoi coal concentrator, and Erdenet copper plant). Moreover, it also aims to expand their digital economy by creating a talent base, so as to develop science-based industries such as that surrounding digital innovation, artificial intelligence, and blockchain.

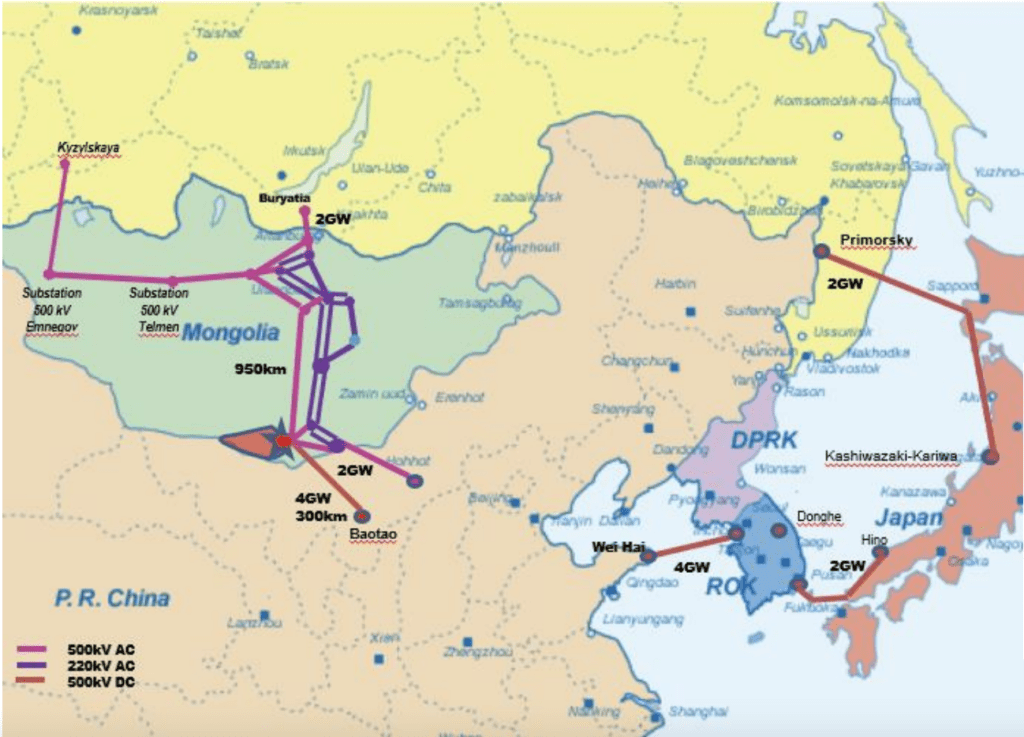

The Energy Revival strategy aims to integrate Mongolia into regional energy networks, and reduce their reliance on energy imports. Such includes the development of a high voltage transmission line which will connect Mongolia and Russia into the Northeast Asian Super Grid (Figure 3),

Figure 3: Mongolia-Russia High Voltage Transmission Line

Orgininal Source: UNESCAP

as well as the construction of the Soyuz-Vostok gas pipeline from Russia through Mongolia to China (Figure 4). The policy also aims to commission new thermal plants and develop energy infrastructure in Mongolia, and invest into less polluting sources of energy, such as hydropower. This feeds into Mongolia’s Green Growth strategy, which aims to promote eco-friendly development through maintaining a ‘balanced ecosystem.’ Such includes the Blue Horse national program, which despite previous controversies surrounding its plans to flood the UNESCO world heritage site ‘Landscapes of Dauria’, the program aims to improve the national supply of drinking water and water for irrigation. Moreover, it also aims to revive dried lakes, ponds and rivers, and transport water to the Gobi region through the construction of dams and reservoirs. The Green Growth strategy also includes the Billion Tree initiative, of which aims to increase total national forest cover by 9% by 2030, the building of recycling plants, as well as the use of advanced sustainable technologies in aimags (provinces) and Ulaanbaator.

Figure 4: Soyuz-Vostok Gas Pipe Line

Source: Gas to power Journal

The Urban and Rural Revival strategy aims to encourage rural development and take the pressure away from cities, such as Ulaanbaatar. As its success depends on the successful implementation of the Port, Energy, and Industrial Revival strategies, the policy will encourage aimags to develop their own projects under the New Revival policy, and will aim to develop their centres as independent cities. Such will reduce urbanisation pressures on Ulaanbaatar, thus reducing the capital’s pollution and traffic congestion levels. The State Productivity Revival policy aims to improve the efficiency of the government by digitalising services, strengthening penalties for corruption and official crimes, and streamlining the administrative structures and government organisations by transferring functions to the private sector and professional associations.

What Can the EU do?

Mongolia has been a beneficiary of the EU’s GSP+ scheme (General Scheme of Preferences Plus) since 2005, and the EU is their third largest trading partner. Moreover, the EU has heavily invested into Mongolia, funding over 150 million EUR into development cooperation projects between 2015 and 2020. Such projects include areas such as the environment and sustainable energy (95 million EUR), mining and infrastructure (42 million EUR), and education, science, culture and health initiatives (21.6 million EUR). The EU TRAM Scheme (Trade Related Assistance for Mongolia) also works with the Mongolian government and businesses to diversify their exports through a value chain development approach, aid them to negotiate and implement trade policies, as well as improve the competitiveness of non-mineral products. This is all whilst ensuring that standards are adhered to by introducing international best practices in trade facilitation. Moreover, the European Bank for Reconstruction and Development (EBRD) has invested over 827 million EUR into the state over the past year, of which 71% (587 million EUR) went into industrial, commercial and agribusiness projects. With such high levels of cooperation, the New Revival’s policies offer even greater opportunities for investment and collaboration between the EU and Mongolia, in particular in mining and energy sectors, as well as in green development.

Mongolia is a mineral-rich country, and the EU invests heavily into sustainable development and trade within the mining sector. Germany, as an example, has a large presence in Mongolia, investing into initiatives promoting the sustainable development of the sector, such as the Integrated Mineral Resources Initiative (IMRI), as well as into initiatives which promote job and skills training, such as the establishment of the German Mongolian Institute for Resource and Technology in Ulaanbaatar, which offers undergraduate and postgraduate programs in engineering. Moreover, the German copper producer Aurubis also signed a 15-year purchase agreement with the Mongolian company MAK in 2016. This agreement will supply 150,000 tons of copper concentrate produced at the Tsagaansuvarga mine to Aurubis.

The Port Revival strategy aims to develop the Free Economic Zones (FEZ) and domestic transport networks through connecting mining sites to both border ports and FEZ and transport hubs. This will allow the EU to further expand their presence in the mining sector, and will also offer the EU opportunities to aid Mongolia in diversifying their export market, especially in the value-added sectors. The recent establishment of the Khushig Valley FEZ will offer VAT and custom-free imports and zero VAT on domestic goods transported to the area. Moreover, its close proximity to the capital city and the New Ulaanbaatar international airport will provide businesses access to the global import and export markets, as well as to the capital’s talent. In aiding Mongolia to work towards the aims of the Industrial and Urban-Rural strategies, the EU could invest into the FEZ, opening value-added mining plants for the export market, and in the case of the Khushig Valley, use their close access to Ulaanbaatar to draw and train local talent. Given Mongolia’s GSP+ status, investment into the FEZs could further aid their export diversification in the mining and agricultural sectors, and expand the amount they export to the EU. Such would be in line with the EU’s Multi-Indicative Programme in Mongolia, and could be bolstered through investments into local infrastructure. Although the EU must take actions to limit the industry’s impact on the environment, such investments would both aid Mongolia in working to become economically independent, as well as further enhance EU-Mongolian ties.

The EU could further invest in projects which aim to reduce energy production and energy uses’ inefficiencies, as well as collaborate with the state and other institutions to fund green energy. At present, the EU funds initiatives such as the ‘Efficiency of Grid-based Energy Supply Schemes’ project (ENEV), which works to improve the energy efficiency of public buildings, and initiatives to improve and modernise technology in power plants. Although many of the newly commissioned thermal plants have received funding from other states, such as South Korea and China, the EU could work to invest into upgrading existing and new plants with technology that reduces consumption inefficiencies, as well as into building more energy efficient plants in import dependent regions, such as those in the western transmission system. Such would have the potential to aid Mongolia to reduce their reliance on energy imports, as well as reduce costs of energy production.

In aiding the state’s green energy transition, the EU could collaborate with the Mongolian government in harnessing their renewable energy source potential. Mongolia has a solar and wind potential that is equivalent to 2,600GW of installed capacity annually, of which meets their domestic energy demands (1.2GW in 2018). As underlined by the Asian Development Bank (ADB), it has not been harnessed due to poor flexible generation, and that the ‘market lacks the system to provide regulation or ancillary service in an efficient manner.’ The ADB has worked to combat this issue by loaning Mongolia 100 million USD to fund the installation of a battery energy storage system (BESS). As underlined by the ADB, This system will have a capacity of 125 MW/160MWh and will ‘supply clean peaking power that is charged by renewable energy electricity and provide regulation reserve to integrate additional renewable energy capacity in the transmission grid.’ The BESS system is estimated to reduce Mongolia’s CO2 emissions by 842,039 tons per year by 2025, and will provide 859GWh of renewable electricity into the central grid annually. Given that France’s energy conglomerate, Engie, already operates a 55 MW wind farm in Sainshand, the EU could further build on such expertise and expand their presence in the country, and collaborate with the Mongolian government in developing their solar and wind energy capacities through the export of solar panels and wind turbines. In ensuring the sector’s development, this could be supported by skills training initiatives. This would both develop a workforce in this sector, as well as aid Mongolia in working to balance urban-rural development by offering high paying jobs outside of urban centres.

With regard to the Green Growth strategy, the EU could also invest into Mongolia’s Billion Tree initiative, as well as support work in the forestry sector. At present, due to high amounts of forest fires, unsustainable forestry and mining activities, and overgrazing, Mongolia is described as the world’s desertification hotspot, with over 90% of the state’s land being at risk. Whilst the Billion Tree national initiative has attracted the support of 300 companies in Ulaanbaatar and has seen Mongolia’s forested area increase by 0.2% between 2016 and 2021 (national forest cover at 8%), there are still criticisms that the initiative remains understaffed. This is especially important as trees require a high amount of care following being planted, and, due to Mongolia’s harsh climate, ongoing special care to ensure their growth and protection. Although Defence Minister Saikhanbayar has underlined that the armed forces will aid in caring for the trees, the state has also articulated their interest in bolstering the sector and opening it up for investment.

As the EU has invested into environmental protection projects in Mongolia, such as Germany’s ‘Protecting Mongolia’s Unique Biodiversity’ initiative, and the Czech Republic’s funding of the ‘Development of Forest and the Gene Pool of Local Forest Tree Ecotypes,’ the EU could both supply seeds for the initiative, as well as invest into further developing skills training in the forestry and agricultural management sectors. Skills training in the short term would foster a talent pool which would protect and aid the forests’ development, and in the long term, would diversify and open up new opportunities in the forestry sector, such as in green tourism. Investments into agricultural management would help improve farming practices, and thus limit the impact which overgrazing has on desertification. Such investments would not only aid Mongolia to reach the goals set out in the Green Growth recovery, but would also bridge their urban-rural development gap by providing high salaried jobs in rural areas.

Ultimately, the New Revival policy both paves a path for Mongolia’s recovery from the pandemic, as well as aids them in becoming economically independent. Although the policy seemingly does not address issues surrounding poverty, a key issue in Mongolia, it nonetheless provides a clear path for social and economic development. Given the sheer amount of investment opportunities this policy offers, the EU should actively consider investing into Mongolia as a means of strengthening bilateral ties, encouraging trade in the mining and energy sectors, as well as in aiding forestry development. Although considerations must be taken surrounding the conditions and the nature of the investment, this policy has the potential to further expand and diversify Mongolia’s export market to the EU under the GSP+ system, and enable EU companies to expand their operations in Mongolia.

Author: Matt Bonini, EIAS Junior Researcher

Photo credits: Wikimedia Commons